- An additional hour of storage increases energy value by up to 81%.

- The addition of 1 to 4 hours of storage capacity enhances the energy value by a further 23%–32%.

- Hybrids with wind have longer storage need than those with solar to reach high capacity credit.

- The Inflation Reduction Act improves the economics for hybrid power plants.

According to Lawrence Berkeley National Laboratory study, adding one hour of energy storage to wind and solar power plants in regions with limited transmission capabilities pushes the value of energy produced from such plants to much higher levels. This, according to the research, shows at 49 percent for those situated near load centers and the “greater than 81% that is feasible in resource-rich regions.”. The results were released last month, unveiling possible advantages from the energy storage aspect of renewable energy.

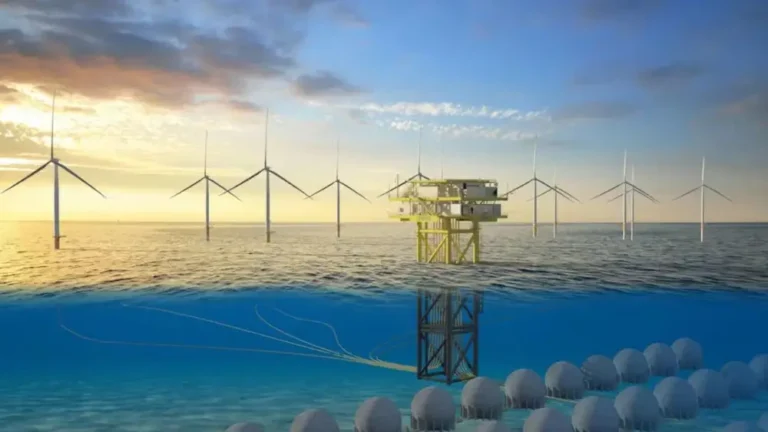

Also read: DNV Launches Phase 2 of Floating Substation Project

In the LBNL study, the principal importance is that the true worth of energy rises sharply when renewable energy plants use energy storage solutions. For example, battery storage can provide an hour’s worth, which can bring significant economic advantage to wind and solar facilities, especially in transmission-constrained regions.

This is not to say that more than one hour of storage capacity cannot add further value increases; indeed, it can, such as a 23% increase for plants in the proximity of load centers and a 32% increase for those in resource-rich regions.

While such results are promising, it was intriguing to the researchers that values beyond four hours of duration do not yield worthwhile energy value. Dev Millstein of LBNL and co-author on the study said of their findings: “We were surprised not to find an energy market incentive for longer-duration storage, particularly in congested areas.”.

Hybrid power plants, especially among solar and battery storage hybrids, are quickly becoming the new trend among U.S. developers. Hybrid systems accounted for 55% of active utility-scale solar capacity and 52% of the energy storage capacity waiting for interconnection as of the end of 2023. Millstein says these trends bode well for hybrid solar developments.

Even as hybrid solar plants are booming, research has revealed that wind plants are far behind in hybridization. In fact, only 14 percent of total requested wind capacity in the interconnection queue had turned hybrid by the end of 2023. “The dynamics of the capacity market can also play a role” here, according to Millstein. Most solar hybrids take four hours of storage to get 90 percent capacity credit. It takes wind hybrids eight hours to be in that league.

Also read: Solar Project Transforms Contaminated Site in Warren County

This is partially due to the fact that the timing of the output of solar energy fits into high demand for electricity, which often occurs in late afternoon or evening. On the other hand, the peak usually falls during the nighttime for wind energy, which makes this less similar to the patterns of demand in the areas. This would therefore indicate that longer-duration storage would prove to be more helpful for the wind hybrids situated in the crowded areas compared to their peers that possess solar technology.

Further, locational and seasonal demand variation could make the potential for capacity credit vary widely. Compared to capacity markets, energy markets have long tended to yield higher revenues for renewable energy plants, but Millstein argues that stronger capacity markets might incentivize developers to build longer-duration storage, even when energy market revenues do not compel them to.

While lithium-ion battery costs are expected to decline by another two-thirds by at least 2028, the clear decline in revenue from further storage beyond four hours in the energy market is such that if this further storage were going to be developed, its cost would have to be very low for developers to view it as worthwhile.

Also read: Latest News on Solar Power, Sunlight Power Energy

Hybrid Plants Also Value Add Financially: The study shows that, contrary to conventional wisdom, grid-charging hybrids are also a financial plus. The system gets arbitrage opportunities as the grid-charging hybrids generate more profit than the same identical facility without grid charging. This would be proved true by using a hybrid plant of four-hour storage solar only with grid power, which generates $12/MWh more than an identical facility without grid charging.

The latest federal expansion of the investment tax credit expanded its reach even to battery storage for solar projects, making hybrids much more economically viable for hybrid power plants.